Notice of Annual Meeting of Shareholders and Proxy Statement Regency Centers.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ý☒ Filed by a Partyparty other than the Registrant ¨

Check the appropriate box:

| Preliminary Proxy Statement | ||

| Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||

| Definitive Proxy Statement | ||

| Definitive Additional Materials | ||

| Soliciting Material | ||

REGENCY CENTERS CORPORATION

(Name of Registrant as Specified inIn Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Thanother than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||||||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||||||

| (1) | ||||||||

Title of each class of securities to which transaction applies: | ||||||||

| (2) | ||||||||

Aggregate number of securities to which transaction applies: | ||||||||

| (3) | ||||||||

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 | ||||||||

| (4) | ||||||||

Proposed maximum aggregate value of transaction: | ||||||||

| (5) | ||||||||

Total fee paid: | ||||||||

| Fee paid previously with preliminary materials. | ||||||||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||||||

| (1) | Amount previously paid: | |||||||

Form, Schedule or Registration Statement No.: | ||||||||

| (3) | Filing party: | |||||||

Date Filed: | ||||||||

Notice of Annual Meeting of Shareholders and Proxy Statement Regency Centers.

Notice of Annual Meeting of Shareholders

TO THE HOLDERS OF COMMON STOCK:

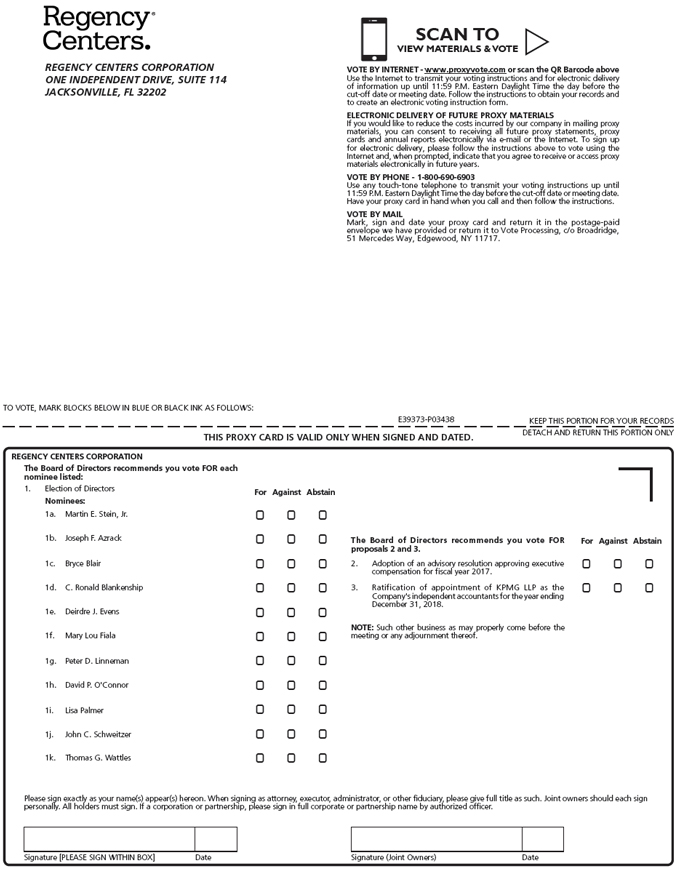

PLEASE TAKE NOTICE that the annual meeting of shareholders of Regency Centers Corporation will be held on Tuesday, May 12, 2015,Thursday, April 26, 2018, at 8:10:30 A.M., Eastern Time, at the Ponte Vedra Inn &and Club, 200 Ponte Vedra Boulevard,Blvd., Ponte Vedra Beach, Florida 32082.

The meeting will be held for the following purposes:

| 1. | To elect as directors the eleven nominees named in the attached proxy statement to serve until the |

| 2. | To approve an advisory resolution approving executive compensation for fiscal year |

| 3. | To ratify the appointment of KPMG LLP as our independent registered public accountants for fiscal year |

| 4. | To transact such other business as may properly come before the meeting or any adjournment. |

The shareholders of record at the close of business on March 18, 20159, 2018 will be entitled to vote at the annual meeting.

By Order of the Board of Directors,

Barbara ChristieC. Johnston

Senior Vice President, Secretary

and General Counsel

Dated: March 27, 2015

MEETING INFORMATION

| DATE: | Thursday, April 26, 2018 | |

| TIME: | ||

| 10:30 A.M., Eastern Time | ||

Ponte Vedra Inn and Club 200 Ponte Vedra Blvd. Ponte Vedra Beach, Florida 32082 | ||

Your vote is important. You are first being sent or made availableeligible to our shareholders on or about March 27, 2015 in connection with the solicitation by our board of directors of proxies to be used at our 2015 annual meeting of shareholders. The meeting will be held on Tuesday, May 12, 2015, at 8:30 A.M., Eastern Time, at the Ponte Vedra Inn & Club, 200 Ponte Vedra Boulevard, Ponte Vedra Beach, Florida 32082.

| BY INTERNET www.proxyvote.com | |

| BY PHONE Call 1.800.690.6903 | |

| BY MAIL Complete, sign and return by free post | |

| IN PERSON Attend the Annual Meeting | |

On or about March 27, 2015,12, 2018, we mailed to our shareholders who have not previously requested to receive these materials by mail ore-mail a Notice of Internet Availability of Proxy Materials containing instructions on how to access this proxy statement and our annual report and vote online. The Notice instructs you as to how you may access and review all of the important information contained in the proxy materials. The Notice also instructs you as to how you may submit your proxy on the Internet or by telephone. If you received the Notice by mail, you will not automatically receive a printed copy of our proxy materials or annual report unless you follow the instructions for requesting these materials included in the Notice.

| Regency Centers Corporation 2018 Proxy Statement i |

| 1 | ||||

| 1 | ||||

| 1 | ||||

| 6 | ||||

| 6 | ||||

| 7 | ||||

| 13 | ||||

| 13 | ||||

| 13 | ||||

| 14 | ||||

| 14 | ||||

| 15 | ||||

| 16 | ||||

| 16 | ||||

| 16 | ||||

| 16 | ||||

| 16 | ||||

| 17 | ||||

| 18 | ||||

| 19 | ||||

| 19 | ||||

| 20 | ||||

| 20 | ||||

| 20 | ||||

| 21 | ||||

| 25 | ||||

Policy on Hedging Transactions, Margin Accounts and Stock Pledges | 26 | |||

| 26 | ||||

| 26 | ||||

| 27 | ||||

| 28 | ||||

| 28 | ||||

| 29 | ||||

| 30 | ||||

| 30 | ||||

| 31 | ||||

| 32 | ||||

| 33 | ||||

| 33 | ||||

| 34 | ||||

| 36 | ||||

| 37 | ||||

| 38 | ||||

| 38 | ||||

| 38 | ||||

| 39 | ||||

| 40 | ||||

Shareholder Proposals and Communications with the Board of Directors | 41 | |||

Frequently Asked Questions Regarding Annual Meeting Procedures | 42 | |||

Appendix A – Definitions and Reconciliations of GAAP andNon-GAAP Financial Measures | A-1 |

| Regency Centers Corporation 2018 Proxy Statement ii |

Annual Meeting of Shareholders | ||||

| Time and Date: | 10:30 A.M., Eastern Time, April 26, 2018 | |||

| Place: | Ponte Vedra Inn and Club 200 Ponte Vedra Blvd. Ponte Vedra Beach, Florida 32082 | |||

| Record Date: | March 9, 2018 | |||

This proxy statement and the accompanying form of proxy are first being sent or made available to our shareholders on or about March 12, 2018 in connection with the solicitation by our board of directors of proxies to be used at our 2018 annual meeting of shareholders.

Shareholder Voting Matters

| Proposals | Board’s Voting Recommendation | Page | ||

| FOR all Director Nominees | 6 | |||

| FOR | 18 | |||

| FOR | 39 |

Our Director Nominees

You are being asked to vote on the election of the eleven director nominees listed below. Directors are elected by a majority of votes cast. Detailed information about each director’s background, skills and expertise can be found in Board of Directors and Corporate Governance section. The board has determined that each nominee is independent except for Mr. Stein and Ms. Palmer. Upon election of these directors at the annual meeting of shareholders, the directors shall hold the committee memberships as follows:

Committee Membership

| ||||||||||||||

| Name and Primary Occupation |  |  |  |  |  |  | ||||||||

Martin E. Stein, Jr. Chairman of the Board and Chief Executive Officer of Regency Centers Corporation | 65 | 1993 | 🌑 | |||||||||||

Joseph F. Azrack Principal of Azrack & Company and Executive Chairman of Safanad real estate group | 70 | 2017 | 🌑 | 🌑 | ||||||||||

Bryce Blair Chairman of Invitation Homes Inc. and Principal of Harborview Associates, LLC | 59 | 2014 |  | 🌑 | ||||||||||

C. Ronald Blankenship Director of Civeo Corp. | 68 | 2001 | 🌑 $ |

| ||||||||||

Deirdre J. Evens Chief of Operations of Iron Mountain Incorporated | 54 | New Nominee | 🌑 | 🌑 | ||||||||||

Mary Lou Fiala Former Chief Operating Officer of Regency Centers Corporation | 66 | 1997 | 🌑 | 🌑 | ||||||||||

Peter D. Linneman Principal of Linneman Associates and of American Land Funds | 67 | 2017 | 🌑 $ | 🌑 | ||||||||||

David P. O’Connor Managing Partner of High Rise Capital Partners, LLC | 53 | 2011 | 🌑 | 🌑 | ||||||||||

Lisa Palmer President and Chief Financial Officer of Regency Centers Corporation | 50 | New Nominee | 🌑 | |||||||||||

John C. Schweitzer President of Westgate Corporation | 73 | 1999 |

| 🌑 | ||||||||||

Thomas G. Wattles Chairman Emeritus of DCT Industrial Trust | 65 | 2001 |

| 🌑 | ||||||||||

🌑 Member  Committee Chair $ Financial Expert

Committee Chair $ Financial Expert

Regency Centers Corporation 2018 Proxy Statement 1

OUR COMMITMENT TO EXCELLENCE IN SHAREHOLDER ENGAGEMENT

Shareholder Engagement

Regular communication with our shareholders is essential to Regency’s long-term success. Throughout 2017, members of our management team participated in robust dialogue and engagement efforts with shareholders to discuss and solicit feedback on a variety of relevant topics including our portfolio, financial and operating performance, capital allocation, corporate governance, executive compensation, the business environment and corporate responsibility initiatives. This regular dialogue with our shareholders has provided us with valuable feedback that has helped influence our decision making, reporting transparency and strategies.

Commitment to Active Shareholder Engagement

| Who | When | How | ||

◾ Shareholders ◾ Fixed-income Investors ◾ Prospective Investors ◾ Sell-side Analysts ◾ ESG Rating Firms ◾ Proxy Advisory Firms | ◾ Year-round ◾ Additional target outreach, which includes at Annual Meeting, Annual Investor Conferences, Industry Conferences (NAREIT, ICSC), Headquarter Visits, Regional Property Tours and Regional Investor Meetings(non-deal roadshows). | ◾ Engagement led by our Capital Markets and Investor Relations teams, including targeted outreach and open lines of communication ◾ Delivery of specific feedback to senior management and the board |

Depth of Engagement

| ◾ | In 2017, we participated in meetings with many investors, which included equity and fixed-income investors across the United States and Europe. |

| ◾ | Investor Relations established a new website to provide enhanced communication with our investors and analysts and aid in our outreach to new potential investors. |

| ◾ | On January 11, 2018, we hosted an Investor Day at the New York Stock Exchange. This Investor Day was attended by over 200 investors and analysts(in-person or via webcast) and presented a unique opportunity for investors and analysts to engage with several Regency Board members in attendance as well as Regency’s Operating Committee and other members of management. |

2 Regency Centers Corporation 2018 Proxy Statement

OUR COMMITMENT TO EXCELLENCE IN SHAREHOLDER VALUE

Creating Shareholder Value

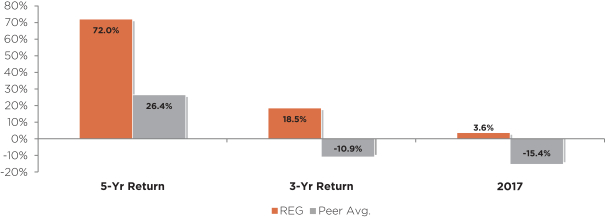

Regency’s unequaled combination of strategic advantages has resulted in consistent execution of our strategy. This is evidenced by Regency’s total shareholder return, which has outpaced the average of our property focused peers over the last one, three, and five year periods.

Total Shareholder Return – REG versus Peer Average

Our property focused peers for the 2017 and the3-year Return are: Weingarten Realty Investors, Federal Realty Investment Trust, Kimco Realty Corporation, Brixmor Property Group, Inc., DDR Corp. and Retail Properties of America, Inc. The companies used for the5-Year Return are the same except Brixmor Property Group, Inc., which was not included because they were not yet publicly listed on an exchange.

OUR COMMITMENT TO EXCELLENCE IN CORPORATE GOVERNANCE

Recent Board Refreshment

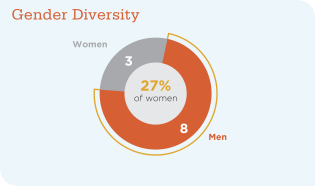

We understand that the quality, dedication and chemistry of our Board have been integral to the Company’s success. To ensure these vital characteristics are maintained in the future, our Board adopted a Board Succession Plan in 2014, laying out a thoughtful, measured path to Board refreshment. The plan wasre-evaluated and updated in 2017 to include, among other things, enhancement of Board diversity and specifically gender diversity.

In just four years since the adoption of the succession plan, and upon the election of the director nominees at the annual shareholders’ meeting in 2018, we will have achieved a significant refreshment of our Board, reflecting a balanced set of more experienced board members and less tenured directors who bring fresh perspectives and differing backgrounds, as follows:

| ◾ | Three of our directors are women |

| ◾ | Four long-tenured independent directors will have retired from our Board in accordance with the refreshment process, bringing the average tenure from 14 years in 2014 to 10 years in 2018 |

| ◾ | Six new directors will have been added since 2014 (one of whom elected in 2017 resigned due to other commitments) |

| ◾ | Average age of directors decreased to 63 years in 2018 |

Regency Centers Corporation 2018 Proxy Statement 3

Characteristics of Board Nominees

|

|

Corporate Governance Highlights

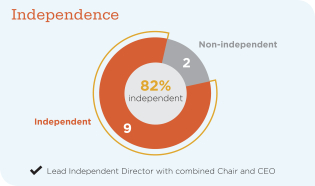

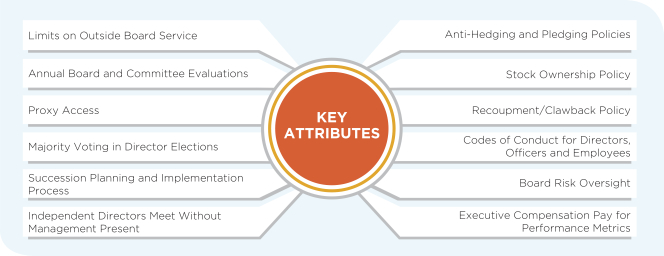

Gender Diversity Women 3 27% of women 8 men Independence Independent 9 82% Independent 2 Non-Independent Lead Independent Director with combined Chair and CEO Tenure Under 10 6 Average of 10 years 5 Over 10 Age Over 7 Average of 63 years 4 under 60 Limits on Outside Board Service Anti-Hedging and Pledging Policies Annual Board and Committee Evaluations Stock Ownership Policy Proxy Access KEY ATTRIBUTES Recoupment/Clawback Policy Majority Voting in Director Elections Codes of Conduct for Directors, Officers and Employees Succession Planning and Implementation Process Board Risk Oversight Independent Directors Meet Without Management Present Executive Compensation Pay For Performance Metrics

4 Regency Centers Corporation 2018 Proxy Statement

OUR COMMITMENT TO EXCELLENCE IN CORPORATE RESPONSIBILITY

Corporate Responsibility Highlights

Regency’s vision is to be the preeminent national owner, operator and developer of shopping centers, connecting outstanding retailers and service providers with its neighborhoods and communities while practicingbest-in-class corporate responsibility.

Our pillars of corporate responsibility of environment, social and corporate governance practices are rooted in Regency’s values.

Environment: Committed to sustainability through reduced energy consumption, water use, greenhouse gas emissions and waste. ◾ Implementation of Regency Green Building Standards applied to all development and redevelopment projects. ◾ Continued energy efficiency implementation to further reduce energy consumption. ◾ Expanded solar energy program offering solar power at shopping centers. | Social: Committed to maintain a strong culture that successfully attracts, retains and engages talented people to achieve the Company’s strategic goals and contribute to the communities where we work and operate. ◾ Dedication to fair compensation, fostering a dynamic and balanced work environment and providing employees developmental opportunities to perform well and derive satisfaction from their work. ◾ Commitment to providing award winning andbest-in-class benefits. ◾ Commitment to contributing to the betterment of our communities through volunteer involvement in local and national charities as well as monetary contributions, which are matched by Regency. |

OUR COMMITMENT TO EXCELLENCE IN PERFORMANCE

2017 Performance Highlights

2017 marked another remarkable year for Regency as we continued our positive momentum in each key facet of our business. The unequaled combination of accomplishments included growth in NAREIT funds from operations (FFO) over 13%, our sixth consecutive year of growth in same property net operating income (NOI) of 3.5% or more, and the development, redevelopment and acquisition of exceptional retail centers.

In 2017, Regency also marked the completion of an important milestone – the completion and successful integration of the merger with Equity One, Inc. The merger enhanced Regency’s already high quality portfolio, while growing our platform in several priority markets and was accretive to earnings and NOI growth while preserving Regency’s strong balance sheet. The merger also added significant compelling redevelopment opportunities to our future development pipeline. Regency is now positioned to realize significant synergies in 2018 related to the merger.

S&P 500 Regency added to S&P 500 $3.09 NAREIT FFO per Share (increased 13% over 2016) 3.6% increase in Same Property Net Operating Income 96.3% Same Property Percent Leased $232 (In millions) Development and Redevelopment starts $150 (In millions) Acquisitions of premier shopping centers

Regency Centers Corporation 2018 Proxy Statement 5

Proposal One: Election Of Directors

Nominees and Director Qualifications

Our articles of incorporation provide for the number of directors to be fixed pursuant to our bylaws, subject to a minimum of three and a maximum of fifteen. Our bylaws provide that the number of directors may not be increased or decreased by more than one without shareholder approval. As of the date of this proxy statement, our board has ten (10) directors. Assuming all nominees are elected, our board will have eleven (11) directors after our annual meeting. At the February 2018 board meeting, Mr. Raymond L. Bank, a long-tenured director, advised the board that he would not stand forre-election. On February 14, 2018, Mr. Chaim Katzman resigned from the board due to his new role as CEO of Gazit-Globe Ltd. and the number of other public company boards he serves. Our board of directors nominated all other existing members to stand forre-election at the 2018 meeting. To fill the remaining board seats, our board of directors has nominated Ms. Lisa Palmer and Ms. Deirdre J. Evens. Except for the two new nominees, all nominees were elected as directors by shareholders at the 2017 annual meeting. All directors elected at the meeting will serve until the 2019 annual meeting and until their successors are elected and qualified.

A governance agreement by and among Regency, Gazit-Globe Ltd. and certain of its affiliated entities (collectively, the “Gazit Parties”) dated as of November 14, 2016 (the “governance agreement”), was entered into in connection with our merger agreement with Equity One, Inc. Pursuant to the governance agreement, upon Mr. Katzman’s resignation, the Gazit Parties have the right to designate another person to be appointed to our board of directors, which person must be reasonably acceptable to our board of directors. As of the date of this proxy statement, the Gazit Parties have not exercised their right to designate another person to be appointed to our board of directors.

The accompanying proxy will be voted for the election as directors of each of the board’s nominees unless a shareholder specifies a contrary choice. Each nominee is presently available for election. If any nominee should become unavailable, which is not now anticipated, the persons voting the accompanying proxy may vote for a substitute nominee designated by our board of directors, or our board may reduce the number of directors.

Our board of directors recommends a vote “for” the election of each of its nominees. Proxies solicited by the board will be so voted unless shareholders specify in their proxies a contrary choice.

6 Regency Centers Corporation 2018 Proxy Statement

The following biographies of our nominees contain information regarding the person’s service as a director, business experience, director positions held currently or at any time during at least the last five years and information regarding involvement in certain legal or administrative proceedings, if applicable. The biographies reflect the committee memberships the nominees shall hold upon their election.

We believe that each nominee possesses the characteristics that are expected of all directors, namely, independence, integrity, sound business judgment and a willingness to represent the long-term interests of all shareholders. The experiences, qualifications, attributes and skills that caused the nominating and corporate governance committee and the board to determine that the person should serve as a director of our Company are described in each nominee’s biography.

| Martin E. Stein, Jr. Age: 65 Director Since: 1993 | Board Committees ◾ Investment | Other public company boards ◾ FRP Holdings, Inc. | |||

Principal occupation or employment ◾ Our Chairman of the Board and Chief Executive Officer since 1998. From our initial public offering in 1993 until 1998, he served as our Chief Executive Officer and President. Mr. Stein also served as President of our predecessor real estate division beginning in 1981, and Vice President from 1976 to 1981. | ||||||

Mr. Stein, a graduate of Washington and Lee University, holds an M.B.A. from Dartmouth College’s Tuck School of Business. Mr. Stein has led our Company since prior to it being a public company. In addition to his leadership skills, he has extensive experience in the real estate industry as past chairman of the National Association of Real Estate Investment Trusts (“NAREIT”), and is a member of the Urban Land Institute (“ULI”), the International Council of Shopping Centers (“ICSC”) and the Real Estate Roundtable. Mr. Stein is a former trustee of Washington and Lee University and ULI and a former director of Stein Mart, Inc. from 2001 to 2014.

| Joseph F. Azrack Age: 70 Director Since: 2017 | Board Committees ◾ Compensation ◾ Investment | Other public company boards ◾ None | |||

Principal occupation or employment ◾ Since January 2015, Mr. Azrack has served as the executive chairman of the Safanad real estate group and as principal of Azrack & Company. | ||||||

Mr.��Azrack, a graduate of Villanova University, holds an M.B.A. from Columbia University. Mr. Azrack served on the board of Equity One, Inc. from 2016 until its merger with us in 2017. Mr. Azrack has extensive real estate and financial expertise. He also has experience as an investor and executive of real estate companies. Mr. Azrack is an adjunct professor at the Columbia University Graduate School of Business where he has taught real estate entrepreneurship since October 2014. Since June 2014, Mr. Azrack has served as a director of the Berkshire Group, a private real estate investment management company focused on multifamily properties and venture investing. From 2008 through 2014, Mr. Azrack was the managing partner, chairman and senior advisor at Apollo Global Real Estate Management, chairman and chief executive officer of Apollo Commercial Real Estate Finance, Inc. and a director of Atrium European Real Estate Ltd., a leading real estate company that owns, operates and develops shopping centers in Central and Eastern Europe.

Regency Centers Corporation 2018 Proxy Statement 7

| Bryce Blair Age: 59 Director Since: 2014 | Board Committees ◾ Nominating and Corporate Governance ◾ Investment | Other public company boards ◾ PulteGroup, Inc. ◾ Invitation Homes, Inc. | |||

Principal occupation or employment ◾ Chairman of Invitation Homes, Inc. and the principal of Harborview Associates, LLC, a company which holds and manages investments in various real estate properties. | ||||||

Mr. Blair, a graduate of the University of New Hampshire, holds an M.B.A. from Harvard Business School. He has served as Chairman of Invitation Homes, Inc. since 2017. Mr. Blair has substantial experience in real estate development and investment, including serving as Chairman, from 2002 through 2013, and Chief Executive Officer, from 2001 through 2012, of AvalonBay Communities, Inc., a real estate investment trust focused on the development, acquisition and management of multi-family apartments throughout the United States. In such capacity, Mr. Blair was responsible for day to day operations and was regularly involved in the preparation and review of complex financial reporting statements. Mr. Blair also serves on the Advisory Board of the MIT Center for Real Estate, the Advisory Board of the Boston College Center for Real Estate and Urban Action, and the Advisory Board of Home Start, anon-profit focused on ending homelessness in the greater Boston area. Prior to the formation of Avalon Properties in 1993, Mr. Blair was a partner with Trammell Crow Residential. Mr. Blair also previously served as senior advisor to McKinsey and Co. and previously served as a part time faculty member at Boston College. Mr. Blair is the past chairman of NAREIT, where he also served on the Executive Committee and the Board of Governors. He is a past member of ULI where he served as a Trustee and was past chairman of the Multi-Family Council. Mr. Blair is a past member of the Young Presidents Organization and a former member of the World Presidents Organization.

| C. Ronald Blankenship Age: 68 Director Since: 2001 | Board Committees ◾ Audit ◾ Investment | Other public company boards ◾ Civeo Corporation | |||

Principal occupation or employment ◾ Former President and Chief Executive Officer of Verde Realty from January 2009 and Chairman and Chief Executive Officer from January 2012 to December 2012 when Verde Realty merged with Brookfield Asset Management. After the merger, Mr. Blankenship continued as Chief Executive Officer until August 2013. | ||||||

Mr. Blankenship, a graduate of the University of Texas, is a certified public accountant and has extensive experience in the REIT industry including cross-border experience. He is an expert in real estate development, acquisitions, financing and operations. He has extensive experience in public company financing, strategic planning, capital allocation, people management and executive compensation. Prior to 2009, he served in various executive and director capacities at Security Capital Group and Archstone Communities Trust. He formerly served as Trustee of Prologis Trust and director of Archstone Communities Trust, BelmontCorp, InterPark Holdings Incorporated, Storage USA, Inc., CarrAmerica Realty Corporation and Macquarie Capital Partners, LLC. He served as Interim Chairman, Chief Executive Officer and director of Homestead Village Incorporated from 1999 until 2001. While he was with Security Capital Group, Security Capital Group had controlling interests in 18 public and private real estate operating companies, eight of which were listed on the NYSE. Prior to joining Security Capital, Mr. Blankenship was a regional partner at Trammell Crow Residential and was on the management board for Trammell Crow Residential Services. Before Trammell Crow, Mr. Blankenship was the chief financial officer and president of office development for Mischer Corporation, a Houston-based real estate development company.

8 Regency Centers Corporation 2018 Proxy Statement

| Deirdre J. Evens Age: 54 Nominee | Board Committees ◾ Audit ◾ Compensation | Other public company boards ◾ None | |||

Principal occupation or employment ◾ Chief of Operations of Iron Mountain Incorporated | ||||||

Ms. Evens, a graduate of Cornell University, currently serves as Chief of Operations of Iron Mountain Incorporated and served as its Chief People Officer and Executive Vice President from July 2015 to January 2018. Prior to her service with Iron Mountain, Ms. Evens served as an Executive Vice President of Human Resources at Clean Harbors, Inc. from 2011 to July 2015, overseeing all aspects of human resources and employee development for a global workforce of more than 13,000 employees. From 2007 to 2011, Ms. Evens served as Executive Vice President of Corporate Sales & Marketing for Clean Harbors. Prior to her service with Clean Harbors, Ms. Evens served as Senior Vice President, Member Insight at BJ’s Wholesale Club from 2006 to 2007 and held a series of positions of increasing responsibility at Polaroid Corporation from 1986 to 2006, including her role as Senior Vice President of Strategy. She has a strong background in corporate strategy, addressing technological change, marketing and human resources.

| Mary Lou Fiala Age: 66 Director Since: 1997 | Board Committees ◾ Investment ◾ Nominating and Corporate Governance | Other public company boards ◾ GGP Inc. | |||

Principal occupation or employment ◾ Former Chief Operating Officer of Regency Centers, from January 1999 to December 2009, President from January 1999 to February 2009, and Vice Chairman until December 2009. | ||||||

Ms. Fiala, a graduate of Miami University, currently serves as a director of GGP Inc. (formerly General Growth Properties, Inc.). Ms. Fiala formerly served as theCo-Chairman of LOFT Unlimited, a personal financial and business consulting firm,non-executive chair ofBuild-A-Bear Workshop, Inc. and as a director of Flat Out Crazy, Inc., a privately held restaurant chain. Prior to joining us, she held a series of executive positions with Security Capital U.S. Realty Strategic Group and Macy’s East/Federated Department Stores. Ms. Fiala has extensive knowledge of our Company from her service both as an officer and as a director. She has significant experience in and knowledge of the retail industry which provides us with great insight into our tenants. She is a former chairman, and current member, of the board of trustees of the ICSC. She has strong skills in operations management, organizational management, marketing and human resources.

Regency Centers Corporation 2018 Proxy Statement 9

| Peter D. Linneman Age: 67 Director Since: 2017 | Board Committees ◾ Audit ◾ Nominating and Corporate Governance | Other public company boards ◾ AG Mortgage Investment Trust, Inc. ◾ Paramount Group, Inc. ◾ Equity Commonwealth | |||

Principal occupation or employment ◾ Principal of Linneman Associates, a real estate advisory firm, and American Land Funds, a private equity firm. | ||||||

Dr. Linneman holds both an M.A. and a doctorate degree in economics from the University of Chicago. He served on the board of Equity One, Inc. from 2000 until its merger with us in 2017. From 1979 to 2011, Dr. Linneman was a Professor of Real Estate, Finance and Public Policy at the University of Pennsylvania, Wharton School of Business and is currently an Emeritus Albert Sussman Professor of Real Estate. He serves as an independent director of AG Mortgage Investment Trust, Inc., Paramount Group, Inc., and Equity Commonwealth. Dr. Linneman served as director of Bedford Property Investors, Inc., Atrium European Real Estate Ltd. and JER Investors Trust, Inc., a finance company that acquires real estate debt securities and loans. He was also chairman of Rockefeller Center Properties. Dr. Linneman has many years of experience in financial and business advisory services and investment activity. He also has experience as a member of numerous public and private boards, including many real estate companies.

| David P. O’Connor Age: 53 Director Since: 2011 | Board Committees ◾ Compensation ◾ Nominating and Corporate Governance | Other public company boards ◾ Paramount Group, Inc. ◾ Prologis, Inc. | |||

Principal occupation or employment ◾ Managing partner of High Rise Capital Partners, LLC andNon-ExecutiveCo-Chairman of HighBrook Investment Management, LP, a real estate private equity firm. | ||||||

Mr. O’Connor, a graduate of the Carroll School of Management at Boston College, holds an M.S. degree in Real Estate from New York University. Mr. O’Connor is an experienced and successful real estate securities investor as well as hedge fund manager. He was theco-founder and Senior Managing Partner of High Rise Capital Management, L.P., a real estate securities hedge fund manager which managed several funds from 2001 to 2011. From 1994 to 2000, he was Principal,Co-Portfolio Manager and Investment Committee Member of European Investors, Inc., a large dedicated REIT investor. He has extensive knowledge and experience in real estate securities and capital markets. He serves on the Board of Trustees of Boston College, the investment committees of endowments for Boston College and Columbia University (Teacher’s College) and serves on the executive committee of the Zell/Lurie Real Estate Center at the University of Pennsylvania’s Wharton School. Mr. O’Connor also serves as a national trustee of PGA REACH, the charitable foundation of the PGA of America. He is a frequent speaker at REIT investment forums and conferences and has served as an Adjunct Instructor of Real Estate at New York University.

10 Regency Centers Corporation 2018 Proxy Statement

| Lisa Palmer Age: 50 Nominee | Board Committees ◾ Investment | Other public company boards ◾ ESH Hospitality, Inc. | |||

Principal occupation or employment ◾ Our President since January 1, 2016 and Chief Financial Officer since January 2013. From 2013 to 2015, she was our Executive Vice President and Chief Financial Officer, and prior to that, served as Senior Vice President of Capital Markets from 2003 until 2013. She served as Senior Manager of Investment Services in 1996 and assumed the role of Vice President of Capital Markets in 1999. | ||||||

Ms. Palmer, a graduate of the University of Virginia, holds an M.B.A. from the Wharton School of the University of Pennsylvania. Ms. Palmer has been with the Company for over 20 years and as a result has extensive knowledge of the shopping center and real estate industries and the Company. Prior to joining Regency, Ms. Palmer worked as a consultant with Accenture, formerly Andersen Consulting Strategic Services, and as a financial analyst for General Electric. She has extensive experience in finance and capital markets, operations, public board strategy and governance. She is a director and chairperson of the nominating and governance committee of ESH Hospitality, Inc., an owner/operator of hotels and the subsidiary of Extended Stay America, Inc., and Brooks Health System, a private healthcare organization. She is also on the board of trustees for the United Way of Northeast Florida, an advisory board member for the Florida Institute of CFOs, a member of ULI, and a member of the ICSC.

| John C. Schweitzer Age: 73 Director Since: 1999 | Board Committees ◾ Compensation ◾ Nominating and Corporate Governance | Other public company boards ◾ Stratus Properties, Inc. | |||

Principal occupation or employment ◾ President of Westgate Corporation, which holds investments in real estate and venture capital operations. He previously served as a member of Pacific Retail Trust’s board of trustees before its merger into Regency in 1999. ◾ Mr. Schweitzer serves as our lead director. | ||||||

Mr. Schweitzer, a graduate of the University of Missouri, holds an M.B.A. from the University of Missouri. He serves on the board of Stratus Properties, Inc., a Texas real estate development company. Mr. Schweitzer previously served as a director or officer of a number of public companies and financial institutions, including Archstone-Smith Trust, J.P. Morgan Chase Bank of Texas-Austin, Franklin Federal Bancorp, Elgin Clock Company, El Paso Electric Company, MBank El Paso, the Circle K Corporation, Homestead Village Incorporated and Enerserv Products. Mr. Schweitzer has served on the boards of numerous public companies, many of which are real estate companies. He has a strong background in business and finance with extensive experience in public company strategies, executive compensation and human resource issues.

Regency Centers Corporation 2018 Proxy Statement 11

| Thomas G. Wattles Age: 66 Director Since: 2001 | Board Committees ◾ Audit ◾ Investment | Other public company boards ◾ Columbia Property Trust | |||

Principal occupation or employment ◾ Chairman Emeritus of DCT Industrial Trust, a publicly held industrial property REIT. | ||||||

Mr. Wattles, a graduate of Stanford University, holds an M.B.A. from the Stanford Graduate School of Business. Mr. Wattles has extensive experience in the REIT industry, including cross-border experience. Mr. Wattles is also a director of Columbia Property Trust, a publicly held office REIT. Mr. Wattles was a principal of both Black Creek Group and Dividend Capital Group LLC, each a real estate investment management firm, from 2003 to 2008. He served as Chief Investment Officer of Security Capital Group from 1997 to 2002. Mr. Wattles was Managing Director, thenCo-Chairman and Chief Investment Officer of ProLogis, Inc. from 1992 to 1997. Mr. Wattles has previously served as a director of Prologis, Inc., Interpark Holdings Incorporated and Security Capital European Realty. At Security Capital Group, he oversaw capital deployment and investments in multiple public and private operating platforms with focus on retail, industrial, parking, manufactured housing and European office sectors. While Mr. Wattles was with Security Capital Group, Security Capital Group had controlling interests in 18 public and private real estate operating companies, eight of which were listed on the NYSE. He is an expert in real estate development, acquisitions, finance and operations. He has significant knowledge of capital allocation, strategic planning and accounting.

12 Regency Centers Corporation 2018 Proxy Statement

Our board of directors has determined that Joseph F. Azrack, Bryce Blair, C. Ronald Blankenship, Mary Lou Fiala, Peter D. Linneman, David P. O’Connor, John C. Schweitzer and Thomas G. Wattles, are “independent” as defined by applicable New York Stock Exchange listing standards and that Deirdre J. Evens will also be independent upon her election.

The board annually reviews all commercial and charitable relationships of directors and determines whether directors meet these categorical independence tests. In making its determination with respect to independence for the directors identified above as independent, the board does not consider any transactions, relationships or arrangements involving these directors that are not disclosed in this proxy statement.

Believing strongly that the quality, dedication and chemistry of the board are key factors in the Company’s success, the board adopted a Board Succession Plan in 2014, establishing a measured plan for board refreshment over a period of years. The board believes that a well-conceived succession plan will help maintain these vital characteristics in the future. The plan is periodicallyre-evaluated and was most recently amended in 2017. Among the goals of the amended Plan are the reduction of the average director tenure and increased diversity, including diversity in gender, ethnicity and experience.

In the four years since the adoption of the board succession plan, four long-term independent directors have retired from our board pursuant to the process set forth in the Plan, including Mr. Bank, who will retire from our board in 2018. In those years, the average tenure has decreased from 14 years to approximately 10 years. If Ms. Palmer and Ms. Evens are elected, our board will have eleven (11) directors after the annual meeting of shareholders in 2018, five of whom will have joined since 2014.

If elected, the newest directors will increase the number of our female directors from one to three.

In our refreshment process, we consider potential candidates from a variety of sources. From time to time, and most recently in 2016 and 2017, we have used an executive search firm to assist us in our goal to increase gender diversity on our board, as well as diversity in experience, skills and perspective. Through these and other means, the board has continued to refresh the board by adding directors who will bring a sufficient range of different perspectives to bear, generate appropriate challenge and discussion, and fulfill its oversight responsibilities to foster significant value creation for our shareholders. We believe that, in alignment with our plan, our board reflects a balanced set of more experienced board members and less tenured directors who bring fresh perspectives.

Procedures for Nomination of Directors

The nominating and corporate governance committee assists the board in establishing criteria and qualifications for potential board members. The committee identifies individuals who meet such criteria and qualifications to become board members and recommends to the board such individuals as nominees for election to the board of directors at the next annual meeting of shareholders.

The nominating and corporate governance committee works with the board of directors to determine the appropriate characteristics, skills and experiences for both individual directors and the board as a whole. The objective is to have a board with diverse backgrounds and experience in relevant areas for the benefit of the Company. Characteristics expected of all directors include independence, integrity, sound business judgment and willingness to represent the long-term interests of all shareholders. In evaluating the suitability of individuals as board members, the committee takes into account many factors but does not have a policy that focuses on any one factor. The factors considered by the committee include: familiarity with our industry; understanding of finance and capital markets; knowledge of the retail industry; expertise in business operations and developing and executing strategies; marketing; disciplines relevant to publicly traded companies; diversity; educational and professional background; and personal accomplishments. In addition, the committee will look for skills and experience that will complement and enhance the board’s existingmake-up including length of anticipated or possible service to assist with board succession and transitions. The committee evaluates each individual in the context of the board as a whole, to recommend a group that can best perpetuate the success of our business.

When vacancies develop, the nominating and corporate governance committee solicits input regarding potential new candidates from a variety of sources, including existing directors and senior management. If the committee deems it appropriate, it engages a third-party search firm. The committee evaluates potential candidates based on their biographical information and qualifications and also arranges personal interviews of qualified candidates by one or more committee members, other board members and senior management.

Directors may not stand forre-election after reaching age 75, unless the board elects to waive the mandatory retirement age.

Regency Centers Corporation 2018 Proxy Statement 13

Shareholder Recommendations for Potential Director Nominees

The nominating and corporate governance committee will consider written recommendations from shareholders for potential nominees for director for election in 2019. The names of suggested nominees, together with the information set forth below, should be submitted for consideration to our Corporate Secretary, at our address set forth on page 41 of this proxy statement, no later than November 12, 2018. The mailing envelope should contain a clear notation indicating that the enclosed letter is a “Shareholder Recommendation for Director.”

To be a valid submission for recommendation to the nominating and corporate governance committee for a potential nominee, the form of recommendation must set forth:

| ◾ | Biographical information about the candidate and a statement about his or her qualifications; |

| ◾ | Any other information required to be disclosed about the candidate under the SEC’s proxy rules (including the candidate’s written consent to being named in the proxy statement and to serve as a director, if nominated and elected); and |

| ◾ | The names and addresses of the shareholder(s) recommending the candidate for consideration and the number of shares of our common stock beneficially owned by each. |

Proxy Access

Our bylaws provide proxy access for shareholders, pursuant to which a shareholder or group of up to 20 shareholders satisfying specified eligibility requirements may include director nominees in our proxy materials for annual meetings. To be eligible to use proxy access, such shareholders must, among other requirements:

| ◾ | have owned shares of common stock equal to at least 3% of the aggregate of our issued and outstanding shares of common stock continuously for at least three years; |

| ◾ | represent that such shares were acquired in the ordinary course of business and not with the intent to change or influence control and that such shareholders do not presently have such intent; and |

| ◾ | provide a notice requesting the inclusion of director nominees in our proxy materials and provide other required information to us not less than 120 days prior to the anniversary of the date of the proxy statement for the prior year’s annual meeting of shareholders (with adjustments if the date for the upcoming annual meeting of shareholders is more than 30 days before or more than 60 days after the anniversary date of the prior year’s annual meeting). |

The maximum number of director nominees that may be submitted pursuant to these provisions may not exceed 25% of the number of directors then in office. Such number will be reduced by the number of individuals that the board of directors nominates forre-election who were previously elected based upon a nomination pursuant to proxy access or other shareholder nomination or proposal.

Proxy access is subject to additional eligibility, procedural and disclosure requirements set forth in our bylaws.

Our board held four regular meetings and two special meetings during 2017. All directors attended at least 75% of all meetings of the board and board committees on which they served during 2017.

Our independent directors meet quarterly in conjunction with the regular board meetings. The independent directors have elected John C. Schweitzer as lead director. As lead director, Mr. Schweitzer presides at the independent directors’ meetings. See “Shareholder Proposals and Communications with the Board of Directors” for information on how to communicate with Mr. Schweitzer or any of the other independent directors.

We do not have a formal policy requiring directors to attend annual meetings of shareholders. However, because the annual meeting generally is held on the same day as a regular board meeting, we anticipate that directors will attend the annual meeting. All of our directors attended the 2017 annual meeting.

Our board of directors has established five standing committees: an audit committee, a compensation committee, a nominating and corporate governance committee, an investment committee and an executive committee, which are described below. Members of these committees are elected annually by our board of directors. The charter of each committee is available on our website at www.regencycenters.com or in printed form by contacting Barbara C. Johnston, Senior Vice President, Secretary and General Counsel at(904) 598-7000.

Our board does not have a policy on whether the same person should serve as both the chief executive officer and chairman of the board or, if the roles are separate, whether the chairman should be selected from the

14 Regency Centers Corporation 2018 Proxy Statement

non-employee directors or should be an employee. Our board believes that it should have the flexibility to periodically determine the leadership structure that it believes is best for the Company. The board believes that its current leadership structure, with Mr. Stein serving as both chief executive officer and board chairman, is appropriate given Mr. Stein’s past experience serving in these roles, the efficiencies of having the chief executive officer also serve in the role of chairman, and our strong corporate governance structure. Pursuant to our governance guidelines, whenever the chairman is an employee of the Company, the board elects a lead director from its independent directors. The lead director is currently Mr. Schweitzer. The chairman and chief executive officer consults periodically with the lead director on board matters, board agendas and on issues facing the Company. In addition, the lead director serves as the principal liaison between the chairman of the board and the independent directors, presides at the executive session ofnon-management directors at each regularly scheduled board meeting, leads the board’s annual evaluation of the chairman and chief executive officer and performs such other duties as may be assigned by the board.

Audit Committee. The audit committee presently is comprised of Thomas G. Wattles (Chairman), Raymond L. Bank, C. Ronald Blankenship and Peter D. Linneman. No member of the audit committee serves on the audit committees of more than three public companies. The audit committee met eight times during 2017. The principal responsibilities of and functions to be performed by the audit committee are established in the audit committee charter. The audit committee charter was adopted by the board of directors and is reviewed annually by the audit committee. See “Audit Committee Report” for a description of the audit committee’s responsibilities.

Our board of directors has determined that Messrs. Bank, Blankenship, Linneman and Wattles are independent as defined under the applicable New York Stock Exchange listing standards and the requirements for audit committee independence under Rule10A-3 promulgated under the Securities Exchange Act of 1394, as amended, and meet the financial literacy requirements of the New York Stock Exchange. Our board of directors also has determined that Messrs. Blankenship, Linneman and Wattles are audit committee financial experts as defined by the rules of the Securities and Exchange Commission.

Compensation Committee. The compensation committee presently is comprised of John C. Schweitzer (Chairman), Joseph F. Azrack, C. Ronald Blankenship and David P. O’Connor, all of whom are independent as defined under the applicable listing standards of the New York Stock Exchange. The compensation committee held three meetings in 2017. The duties of the compensation committee include:

| ◾ | establishing compensation plans and compensation policy; |

| ◾ | approving compensation arrangements for senior management, including annual incentive and long-term compensation; |

| ◾ | reviewing leadership development and succession planning; and |

| ◾ | making grants under our Long Term Omnibus Plan. |

Nominating and Corporate Governance Committee. The nominating and corporate governance committee presently is comprised of Bryce Blair (Chairman), Raymond L. Bank, David P. O’Connor, Mary Lou Fiala and John C. Schweitzer, met four times during 2017. All members of the nominating and corporate governance committee are independent as defined under the applicable listing standards of the New York Stock Exchange. The duties of the nominating and corporate governance committee include:

| ◾ | assisting our board in establishing criteria and qualifications for potential board members; |

| ◾ | identifying high quality individuals who have the core competencies, characteristics and experience to become members of our board and recommending to the board the director nominees for the next annual meeting of shareholders; |

| ◾ | establishing corporate governance practices in compliance with applicable regulatory requirements and consistent with the highest standards, and recommending to the board the corporate governance guidelines applicable to us; |

| ◾ | leading the board in its annual review of the board’s performance and establishing appropriate programs for director development and education; and |

| ◾ | recommending nominees for each committee of the board. |

Investment Committee. The investment committee presently is comprised of C. Ronald Blankenship (Chairman), Bryce Blair, Mary Lou Fiala, Martin E. Stein, Jr., and Thomas G. Wattles. The investment committee met eight times during 2017. The duties of the investment committee include:

| ◾ | reviewing and approving our capital allocation strategy; |

| ◾ | approving investments and dispositions exceeding certain thresholds; and |

| ◾ | reviewing our investment and disposition programs and the performance ofin-process developments. |

Regency Centers Corporation 2018 Proxy Statement 15

Executive Committee. The executive committee is constituted as needed and shall include Martin E. Stein, Jr. (Chairman) and any two other directors who qualify as independent, as defined by the listing standards of the New York Stock Exchange, and who are available to meet when committee action is required. If Mr. Stein is unavailable, the lead director would serve in his place. The executive committee is authorized by the resolutions establishing the committee to handle ministerial matters requiring board approval. The executive committee may not perform functions reserved under Florida law or the rules of the New York Stock Exchange for the full board of directors and, in addition, may not declare dividends. There were no meetings of the executive committee during 2017.

Our board of directors has long maintained corporate governance guidelines, including a code of business conduct and ethics for our directors, officers and employees. The corporate governance guidelines and code of conduct are posted on our website at www.regencycenters.com.

Our board of directors is aware of the concept of “overboarding” which refers to a director serving on an excessive number of boards. Such excessive commitments can lead to a director being unable to appropriately fulfill his or her duties. Our corporate governance guidelines have long limited the number of boards on which our directors and officers can serve. Our corporate governance guidelines further provide that no more than two active Regency executives may serve on our board at any time. Our current guidelines provide the following limitations:

| Position | Maximum Number of Public Company Boards* | |||

Independent director holding full-time executive position with another company | 2 | |||

Independent director who is not a full-time executive | 4 | |||

Regency CEO, President and CFO | 2 | |||

Other Regency officers | 1 | |||

* The number of public company boards includes Regency’s board of directors.

Our board is actively involved in oversight of risks that could affect the Company. This oversight is conducted primarily through committees of the board as disclosed in the descriptions of each of the committees herein and in the charters of each of the committees, but the full board has retained responsibility for general oversight of risks. The board satisfies this responsibility through full reports by each committee chair regarding the applicable committee’s considerations and actions, as well as through regular reports directly from officers responsible for oversight of particular risks within the Company. In 2017, the Company formed a cyber risk committee comprised of key members of management and other employees that is focused on managing our cyber risks. This committee reports quarterly to our audit committee.

Risk Consideration in our Compensation Program

The board believes that our compensation policies and practices for our employees are reasonable and properly align our employees’ interests with those of our shareholders. The board believes that there are a number of factors that cause our compensation policies and practices to not have a material adverse effect on the Company. The fact that our executive officers have their annual and long term incentive compensation tied to financial metrics as well as total shareholder return as compared to a peer group encourages actions that focus on profitable business for the benefit of shareholders. Our stock ownership policy and our policy prohibiting stock hedging transactions further align the interest of our senior officers with the long term interests of our shareholders. In addition, there are significant checks in place within our compensation structure so that employees whose compensation may have a shorter term focus are managed by employees and officers whose compensation has a longer term focus.

Compensation Committee Interlocks and Insider Participation

During the last fiscal year, no member of the compensation committee had a relationship with us that required disclosure under Item 404 of RegulationS-K. During the past fiscal year, none of our executive officers served as a member of the board of directors or compensation committee, or other committee serving an equivalent function, of any entity that has one or more executive officers who served as members of our board of directors or our compensation committee. None of the members of our compensation committee is an officer or employee of our Company, nor have they ever been an officer or employee of our Company.

16 Regency Centers Corporation 2018 Proxy Statement

During 2017, we paid ournon-employee directors an annual cash retainer of $60,000. Members of the audit committee and the investment committee received annual retainers of $15,000. Members of the nominating and corporate governance committee and the compensation committee received annual retainers of $10,000. The annual retainer for our lead director was $27,000. The chairpersons of the audit committee and the investment committee received annual retainers of $20,000. The chairpersons of the nominating and corporate governance committee and the compensation committee received annual retainers of $12,000.

We pay directors’ fees quarterly, in cash or, at the election of the director, shares of common stock issued under our Omnibus Incentive Plan and valued based on the average closing price of our common stock during the quarter in which the fees are earned. Directors may defer their fees, at their election, under ournon-qualified deferred compensation plan.

Non-employee directors also receive stock rights awards of 2,000 shares each immediately following the annual meeting of shareholders. Stock rights granted prior to 2018 vest 25% on each of the first four anniversary dates of the grant. Stock rights granted in 2018 or later vest 100% on the first anniversary date of grant.

DIRECTOR COMPENSATION FOR 2017

Name

| Fees Paid in

| Stock

| Total

| |||||||||

Joseph F. Azrack

| $

| 58,333

|

| $

| 128,140

|

| $

| 186,473

|

| |||

Raymond L. Bank

| $

| 85,000

|

| $

| 128,140

|

| $

| 213,140

|

| |||

Bryce Blair

| $

| 85,750

|

| $

| 128,140

|

| $

| 213,890

|

| |||

C. Ronald Blankenship

| $

| 115,000

|

| $

| 128,140

|

| $

| 243,140

|

| |||

J. Dix Druce, Jr.(3)

| $

| 36,667

|

|

| —

|

| $

| 36,667

|

| |||

Mary Lou Fiala

| $

| 85,000

|

| $

| 128,140

|

| $

| 213,140

|

| |||

Chaim Katzman

| $

| 62,500

|

| $

| 128,140

|

| $

| 190,640

|

| |||

Peter D. Linneman

| $

| 62,500

|

| $

| 128,140

|

| $

| 190,640

|

| |||

David P. O’Connor

| $

| 81,250

|

| $

| 128,140

|

| $

| 209,390

|

| |||

John C. Schweitzer

| $

| 119,000

|

| $

| 128,140

|

| $

| 247,140

|

| |||

Thomas G. Wattles

| $

| 110,000

|

| $

| 128,140

|

| $

| 238,140

|

| |||

| (1) | The following directors elected to receive certain of their directors’ fees in the form of shares of our common stock in lieu of cash: |

| Director | Number of Shares Issued in Lieu of Directors’ Fees | |||

Joseph F. Azrack | 899 | |||

C. Ronald Blankenship | 1,760 | |||

Peter D. Linneman | 963 | |||

| (2) | The amounts in this column represent the aggregate grant date fair value computed in accordance with FASB ASC Topic 718 which was $64.07 per share on April 27, 2017 for all directors. |

| (3) | Mr. Druce served as director until our annual shareholders meeting on April 27, 2017. |

Regency Centers Corporation 2018 Proxy Statement 17

Proposal Two: Advisory Vote on Executive Compensation

We design our executive officer compensation programs to attract, motivate, and retain executives who are capable of achieving our key strategic goals. Our compensation programs are designed to be competitive with comparable employers and to align the interests of management with shareholders by awarding incentives for the achievement of specific key objectives. Pay that reflects performance and alignment of that pay with the interests of long-term shareholders are key principles that underlie our compensation program design. We encourage you to closely review our “Compensation Discussion and Analysis” and “Executive Compensation” sections.

The compensation committee continues to refine our executive compensation practices and policies consistent with evolving governance practices. We believe that the compensation actually received by our executives reflects our goal to align the interests of management with shareholders. We believe the following items reflect our commitment to pay for performance and to maintain a strong executive compensation governance framework.

| ◾ | We have endeavored to align base salaries and target total direct compensation moderately below, at or moderately above the market median. |

| ◾ | Our annual bonus plan is entirely based on corporate or regional financial results. |

| ◾ | Our annual long-term incentive award for our named executive officers is largely based upon our total shareholder return relative to the FTSE NAREIT U.S. Shopping Center Index. |

| ◾ | Our executives have severance agreements but not employment agreements. These agreements do not provide taxgross-ups and do not have single triggers in the event of a change of control, other than in the limited instance in which our stock is no longer publicly-traded following a change of control, in which case equity awards become vested and converted to a cash payment. |

| ◾ | We do not offer pension plans for our executive officers or our other employees. |

| ◾ | We have a stock ownership policy that requires our executive officers to own a significant multiple of their base salary and to retain a percentage of the shares subsequently awarded to them. |

| ◾ | We prohibit our officers and directors from engaging in hedging transactions or arrangements designed to lock in the value of their Company securities. |

| ◾ | We prohibit our officers and directors from holding Company securities in a margin account or pledging Company securities as collateral for a loan. |

| ◾ | We have an expansive clawback/recoupment policy for current and former executive officers. |

In accordance with SEC rules, you are being asked to approve an advisory resolution on the compensation of our named executive officers. This proposal, commonly known as a “say on pay” proposal, gives you the opportunity to endorse or not endorse our fiscal year 2017 compensation program and policies for our named executive officers. Although this advisory vote isnon-binding, our board and compensation committee will review the voting results. To the extent there is any significant negativesay-on-pay vote, the board and compensation committee would consider constructive feedback in making future decisions about executive compensation programs.

Our board recommends a vote “for” approval of the following resolution:

RESOLVED, that the holders of common stock of Regency Centers Corporation approve, on an advisory basis, the 2017 compensation of the Company’s named executive officers as described in this proxy statement under the headings “Compensation Discussion and Analysis” and “Executive Compensation.”

18 Regency Centers Corporation 2018 Proxy Statement

Compensation Discussion and Analysis

Except as otherwise specified, the following compensation discussion and analysis focuses on our CEO and the other executive officers named in our Summary Compensation Table. We refer to these individuals as our “named executive officers” or “NEOs.”

The compensation committee of our board of directors is focused on executive compensation being appropriate in amount and form. The compensation committee strives to align the interests of our executive team with the interests of our shareholders by providing incentives based upon the achievement of performance levels in relation to our strategic goals. Our board of directors and our compensation committee value the opinions of our shareholders and are committed to ongoing engagement with our shareholders on executive compensation practices. The compensation committee specifically considers the results from the annual shareholder advisory vote on executive compensation. At the 2017 annual meeting of shareholders, more than 98% of the votes cast on the shareholder advisory vote on executive compensation were in favor of our executive compensation.

Our operational and financial performance in 2016 that was considered by our board of directors and compensation committee in determining targeted executive compensation for 2017 included:

| ◾ | Net Income |

Net income increased to $143.9 million or $1.42 per share, an increase of 4.4% per share from 2015.

| ◾ | Relative Total Shareholder Return |

Over the three-year period ending in 2016, our total shareholder return was 63% versus 41% for the FTSE NAREIT U.S. Shopping Center Index (2200 basis points of outperformance).

| ◾ | Core FFO Growth |

We experienced 8.2% growth in Core FFO per share, our third consecutive year of 7%+ growth.

| ◾ | Same Property NOI Growth |

We experienced 3.5% growth in Same Property NOI without termination fees after exceeding 4.0% for the four consecutive prior years.

| ◾ | Developments and Redevelopments |

We had $218 million in project starts in 2016 (before partner participation) and had $174 million in project completions in 2016.

| ◾ | Acquisitions and Dispositions |

We had $352 million in property acquisitions and $169 million in property dispositions.

| ◾ | Balance Sheet Management |

We improved our debt to EBITDA ratio to 4.4x. We increased our fixed charge coverage to 3.3x.

In view of our financial performance in 2016 as well as other business accomplishments and peer benchmarking, the compensation committee of our board of directors increased targeted total direct compensation for our NEOs by approximately 5.2% for 2017. Our continued operational and financial progress in 2017 resulted in the Company achieving a number of performance highlights in 2017 as well as the successful integration of Equity One, Inc.

| ◾ | Net Income |

Net income increased to $159.9 million or $1.00 per share.

| ◾ | Relative Total Shareholder Return |

Over the three-year period ending in 2017, our total shareholder return was 19% versus-4% for the FTSE NAREIT U.S. Shopping Center Index (2300 basis points of outperformance).

| ◾ | Core FFO Growth |

We experienced 9.7% growth in adjusted Core FFO per share.

Regency Centers Corporation 2018 Proxy Statement 19

| ◾ | Same Property NOI Growth |

We experienced 3.6% growth in Same Property NOI without termination fees.

| ◾ | Developments and Redevelopments |

We had $232 million in project starts in 2017 (before partner participation) and had $132 million in project completions in 2017.

| ◾ | Acquisitions and Dispositions |

We had $150 million in property acquisitions and $120 million in property dispositions.

| ◾ | Balance Sheet Management |

Our debt to EBITDA ratio was 5.4x. We increased our fixed charge coverage to 4.1x.

| ◾ | Efficiency |

We reduced our G&A/revenues under management to 5.0% from 6.6%.

| ◾ | Successfully integrated merger with Equity One, Inc. |

Please see Appendix A for definition of the above terms and a reconciliation of the above metrics to results reported in accordance with generally accepted accounting principles.

Compensation Program Objectives and Overview

Our compensation program is designed to attract, motivate, and retain executives who are capable of achieving our key strategic goals. We compensate our executives through a mix of base salary, annual cash incentives, and long-term equity compensation with an emphasis on the role of incentives in contributing to total compensation. Our compensation programs are designed to be competitive with comparable employers and to align the interests of management with shareholders by awarding incentives for the achievement of specific key objectives.

The compensation committee of our board of directors is responsible for implementing our executive pay philosophy, evaluating compensation against the market, and approving the material terms of executive compensation arrangements, such as incentive plan participants, award opportunities, performance goals, and compensation earned under incentive plans. The committee is comprised entirely of independent directors as defined by the New York Stock Exchange.

The committee evaluates the performance of the CEO and determines his compensation based on this evaluation. With respect to our other executive officers, the committee considers the CEO’s input as to performance evaluations and recommended compensation arrangements. With respect to our executive vice presidents, the committee considers the CEO’s and the president’s input as to performance evaluations and recommended compensation arrangements. The compensation of all named executive officers is subject to the final approval of the committee.

Management and the committee rely upon outside advisors to determine competitive pay levels, evaluate pay program design, and assess evolving technical constraints. During 2017 the committee engaged Willis Towers Watson to evaluate competitive pay practices, assist in the refinement of our incentive plans and assist in the preparation of our pay disclosures and valuation of our equity awards.

A representative from Willis Towers Watson generally attends meetings of the compensation committee, and is available to participate in executive sessions and to communicate directly with the compensation committee chair or its members outside of meetings.

The compensation committee considers all factors relevant to the consultant’s independence from management, including those identified by the NYSE. The compensation committee has determined that Willis Towers Watson has no conflict of interest and is independent.

Targeted Level of Compensation

We rely on the peer group analysis prepared by Willis Towers Watson described below as well as the compensation survey of NAREIT to evaluate pay levels for our named executive officers. The consultant to the compensation committee analyzes competitive total direct compensation at the peer REITs listed below, as disclosed in their proxy statements for prior years. We evaluate the appropriateness of the group annually (based on merger and acquisition activity, growth, property focus, etc.) and make adjustments accordingly.

20 Regency Centers Corporation 2018 Proxy Statement

The principles by which the peer group was created and maintained are that companies be in a comparable industry (i.e. REITs) and comparable in size, generally based on total market capitalization ranging from half to double our size. In 2016, the peer group was changed to reflect the Equity One, Inc. transaction increasing Regency’s size.

The peer group reviewed in 2016 for setting 2017 compensation included:

| Brixmor Property Group, Inc. | The Macerich Company | |

| DDR Corp. | Realty Income Corp. | |

| Federal Realty Investment Trust | Retail Properties of America, Inc. | |

| GGP, Inc. | Tanger Factory Outlet Centers Inc. | |

| Kimco Realty Corporation | Taubman Centers Inc. | |

| National Retail Properties, Inc. | Weingarten Realty Investors |

In the fall of 2017, the composition of the peer group was changed by the compensation committee to better reflect the Company’s increased market capitalization and to include“best-in-class” REITs regardless of property focus. The revised peer group that will be used for setting 2018 compensation includes:

| Boston Properties, Inc. | Kimco Realty Corporation | |

| Brixmor Property Group, Inc. | The Macerich Company | |

| DDR Corp. | National Retail Properties, Inc. | |

| Essex Property Trust, Inc. | Realty Income Corp. | |

| Federal Realty Investment Trust | Taubman Centers, Inc. | |

| GGP, Inc. | VEREIT, Inc. | |

| Host Hotels & Resorts, Inc. | Weingarten Realty Investors |

We endeavor to set total direct compensation, which consists of base salary, annual cash incentives and the expected value of long-term incentives, for target performance levels moderately below, at or moderately above the peer median depending on company and market circumstances as well as the experience level of the individual executive. Annual increases in base salary, cash incentives, performance shares and total direct compensation will be more robust when pay is below the median and more moderate when those compensation levels are more than 10% above the median or exceed the peer 60th percentile. Compensation for top executives will be highly variable with heavy weighting toward incentive compensation rather than fixed components.

In allocating compensation, we believe the compensation of senior levels of management should be predominantly performance-based since these levels of management have the greatest ability to influence corporate performance. The table below summarizes the allocation of the 2017 compensation opportunity for our named executive officers and all other executives based upon the three primary elements of compensation (base salary, annual cash incentive, and long-term incentives).

Elements of Compensation Opportunity *

Element

| Average of

| Average of

| ||||||

Base salary

|

| 23

| %

|

| 56

| %

| ||

Annual incentives

|

| 24

| %

|

| 22

| %

| ||

Long term incentives

|

| 53

| %

|

| 22

| %

| ||

* Opportunity at target for all persons

We generally aim to align with the market in each of the three pay elements as defined in ourpay-for-performance philosophy.

The elements of 2017 compensation are discussed in more detail below.

Base Salary

Base salaries are reviewed annually. The following factors are considered in determining salary adjustments: market competitiveness, the roles and responsibilities of the executives, their contributions to the Company’s business, an analysis of job requirements and the executives’ prior experience and accomplishments.

Base salaries were increased in 2017. Our NEOs received base salary increases that ranged from 3.6% to 4.0%.

Regency Centers Corporation 2018 Proxy Statement 21

Annual Cash Incentive—Overview

Regency pays an annual cash incentive based on achievement of key corporate objectives. The compensation committee continued Core FFO per share as the sole metric that annual cash incentives should be based upon in 2017 for our NEOs.

The compensation committee believes Core FFO is representative of our ability to meet our financial commitments, make distributions to shareholders on a sustainable basis and is a representative indicator of growth in our net asset value.

The portion of the 2017 annual cash incentive for our named executive officers based on achieving specified levels of Core FFO per share in 2017 is set forth in the following table. Our compensation committee considered, among other things, the impact of our merger with Equity One, Inc. in determining the Core FFO per share criteria. To encourage our NEOs to take actions that are in the long-term interests of the Company, our compensation committee may normalize the calculation of Core FFO per share to not penalize (or overly-benefit) our NEOs for taking actions that are in the best interest of our Company over the long-term but that have a negative impact on Core FFO such as the sale of assets and debt reduction. In 2017 we normalized Core FFO for incentive compensation purposes by excluding $14.4 million ofnon-cash revenues, or $0.08 per share, from Core FFO that were a result of purchase accounting adjustments related to the merger with Equity One. In 2017, our adjusted Core FFO per share was $3.61.

2017 Performance Criteria of Core FFO per Share for Annual Cash Incentives

2017 Core FFO per Share

| Performance

| Multiple of

| ||||

$3.62

| Exceptional

|

| 1.50

|

| ||

$3.55

| Stretch Goal

|

| 1.25

|

| ||

$3.49

| Target

|

| 1.00

|

| ||

$3.39

| Low

|

| 0.50

|

| ||

Payouts for performance above $3.62 would be interpolated up to a maximum of 2 times target for performance up to $3.75 per share. Payouts for performance below $3.39, if any, would be made at the discretion of the compensation committee.

Annual Cash Incentive—2017 Results v. 2017 Incentive Plan Goals

Our NEOs received the following cash awards for Core FFO per share, which was $3.61 per share adjusted which translated into an award of 146% of the target award:

Name

| 2017 Cash

| 2017 Cash

| ||||||

Martin E. Stein, Jr.

| $

| 1,190,000

|

| $

| 1,737,400

|

| ||

Lisa Palmer

| $

| 570,000

|

| $

| 832,200

|

| ||

James D. Thompson

| $

| 468,000

|

| $

| 683,280

|

| ||

Dan M. Chandler, III

| $

| 468,000

|

| $

| 683,280

|

| ||

Long-Term Incentives—Overview